SBADNA ANALYTICS

TOP SBA 7(a) LENDERS

About SBA Lenders Over the Last 12 Months

SBA 7(a) Loans From 7/1/2023 to 6/30/2024

1,425

SBA Lenders

Approved a Loan

624

Number of Banks

With a Loan Approval

Over $1 Million

8

Number of Lenders

Funding Over 1,000

SBA Loans

1,216

SBA Lenders

Funded a Loan

217

Number of Banks

With a Franchise Approval

Over $1 Million

43

Number of Lenders

Funding Over 100

SBA Loans

$444K

Average Amount

Approved

567

Number of Banks

With a Franchise

LoanApproval

36%

Percentage of Lenders

Approving Who Funded

10+ SBA Loans

$454K

Average Amount

Funded

72%

Percentage of Loans

Approved by

Out-of-state Lenders

51%

Percentage of Lenders

Approving Who Funded

5 or Less SBA Loans

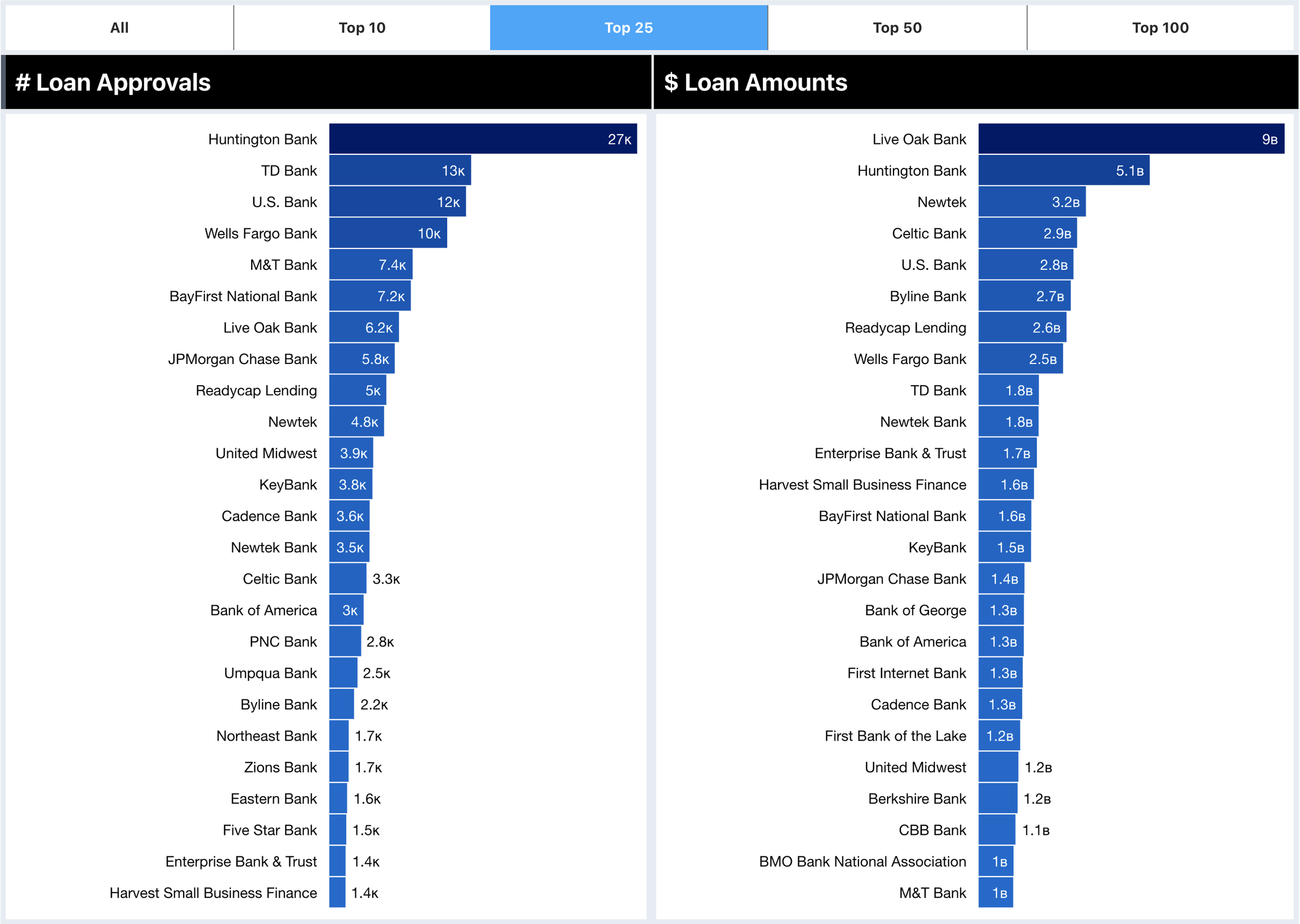

Top 25 Lenders For SBA 7(a) Lending Approvals

2024 Mid-Year

Top 25 Lenders For SBA 7(a) Lending Approvals

Last 12 Months Ending 6/30/24

Top 25 Lenders For SBA 7(a) Lending Approvals

Last 2 Years Ending 6/30/24

Top 25 Lenders For SBA 7(a) Lending Approvals

Last 5 Years Ending 6/30/24

SBADNA Analytics

All SBA data mentioned or shared on this website comes from the lending analytics platform developed and maintained by SBADNA Analytics. SBADNA and LoanBox are both owned by the same parent company FuseSync LLC. Neither LoanBox nor SBADNA validates or verifies the source data released by the SBA.

Data Source & Methodology

The original source of SBA loan data is derived from data released by the U.S. Small Business Administration (SBA). The SBA collects individual loan data from the SBA lender/bank approving and providing SBA loans. The SBA then makes basic loan data public through the FOIA (Freedom of Information Act) requirements. The SBA FOIA data is imported into the SBADNA advanced analytics platform which is then used to generate the reports and rankings

Read more about SBADNA utilizing SBA loan data source and methodology.