ABOUT

BORROWER

LENDERS

FRANCHISORS

VENDORS

PLATFORM

CONTACT

COSTS

LoanBox is Free*

All LoanBox loan packaging, processing, and consulting is free to borrowers for loans over $250,000.

*Loans Under $250,000

LoanBox Advisor Navigation: $2,500 added to loan and only paid to LoanBox from bank if loan closes.

LoanBox Delivers Value:

Full access to LoanBox and LoanBox advisors is free for loans over $250,000.

For loans under $250,000 a $2500 packaging and support fee is added to the loan and only paid if the loan closes.

Vendors do not pay a commission or referral fee to LoanBox for any business they generate on LoanBox, ensuring you get the best pricing available.

Lenders offer more aggressive loan rates due to the efficiency of LoanBox in originating exact match loans. Lenders pay a small platform fee which is the same or less than what most lenders budget for business development costs. In short, LoanBox provides borrowers with the best of both worlds in right matched lender selection and pricing.

The biggest value is the efficiency in a borrower having everything and everyone needed in one place which streamlines the process and costs. LoanBox saves borrowers a lot of time, money, and stress by helping business owners get it right the first time around.

Interest is the largest cost to financing.

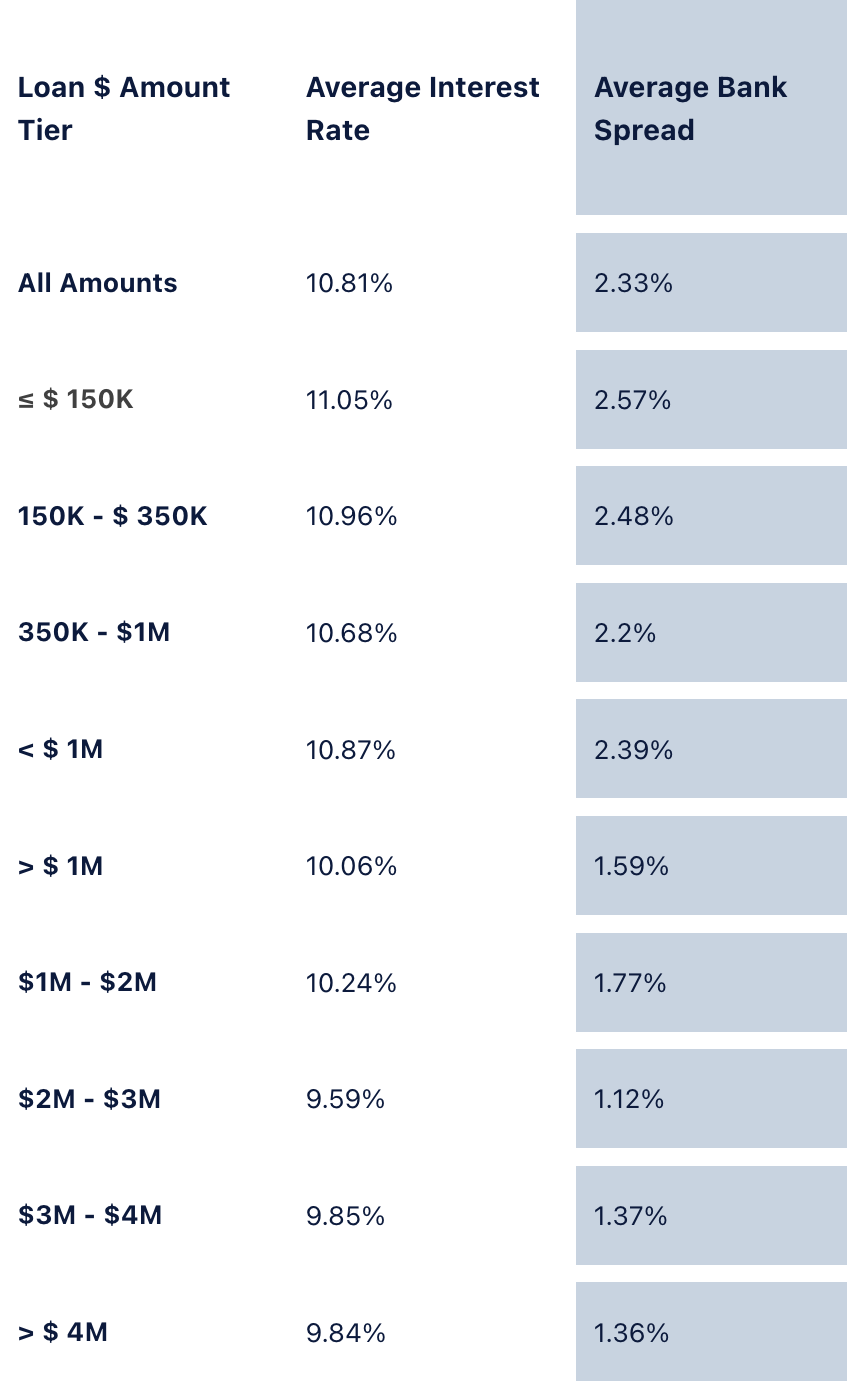

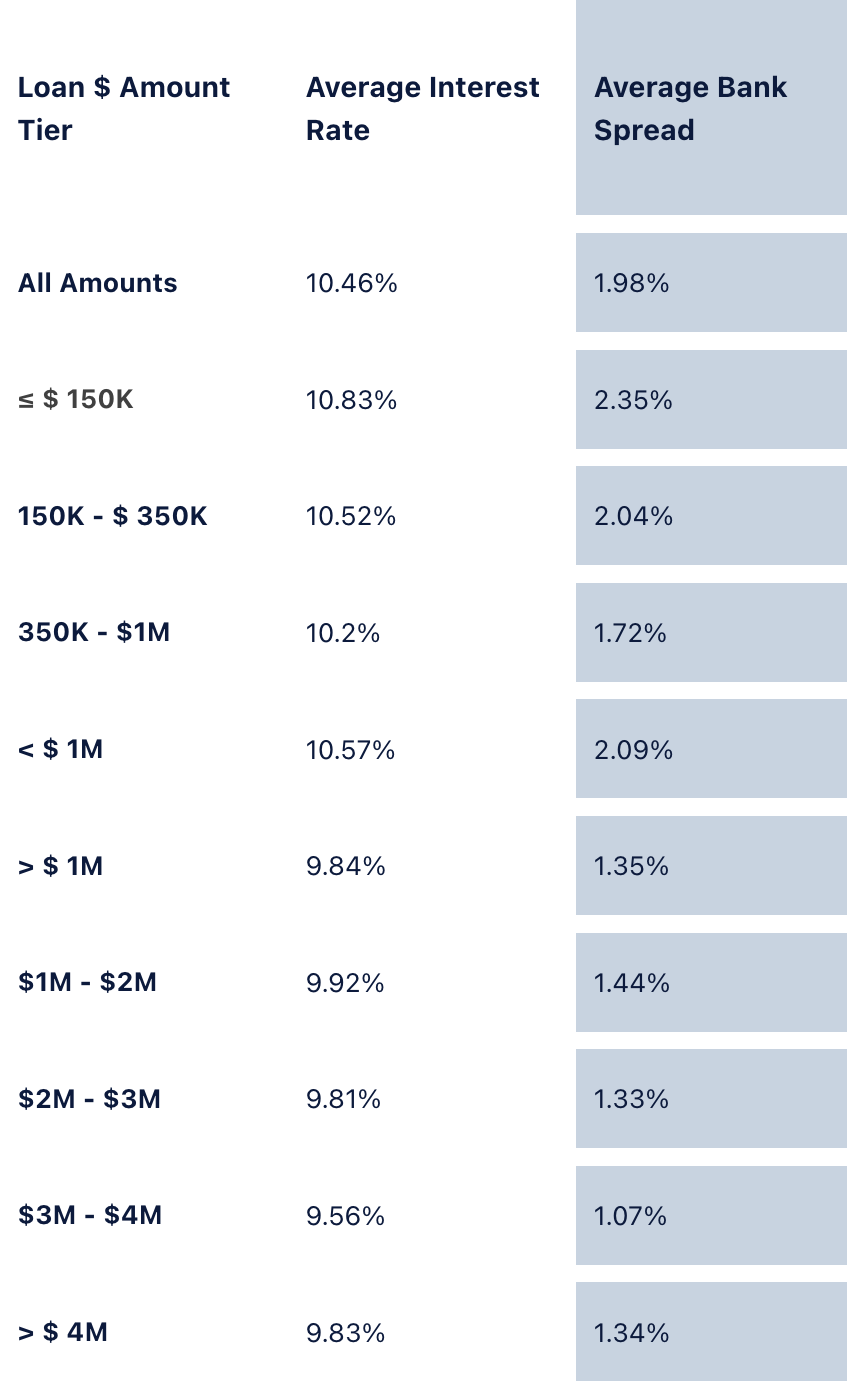

We used our SBA lending analytics platform to find the average rate spread and rate franchise and non-franchise borrowers received on average. Based on all SBA 7(a) loans.

FRANCHISE BUSINESSES

AVERAGE INTEREST RATES OVER LAST YEAR

LAST 12 MONTHS ENDING MID-YEAR 2024

STARTUPS

CHANGE OF OWNERSHIP

BUSINESSES < 2 YEARS

BUSINESSES > 2 YEARS

Interest Rate Analytics From SBADNA Analytics Platform.

NON-FRANCHISE BUSINESSES

AVERAGE INTEREST RATES OVER LAST YEAR

LAST 12 MONTHS ENDING MID-YEAR 2024 FOR ALL SBA LENDERS

STARTUPS

CHANGE OF OWNERSHIP

BUSINESSES < 2 YEARS

BUSINESSES > 2 YEARS

FINANCE

YOUR WAY

DO-IT-YOURSELF BUSINESS LOANS

Complete application and loan package

See matching lenders

Select one or all matching lenders to access your loan package

Receive loan proposals from interested lenders

Select the winning lender and e-sign their loan proposal

Use the tools and intel available, follow the process, receive alerts at every stage along the way, and utilize LoanBox human support as needed.

LOANBOX ADVISOR SUPPORTED LOANS

Complete applicant summary form

Have consultation

Upload the docs requested

Receive, discuss, and approve your LoanBox Advisor plan

Provide needed docs as requested as your Advisor navigates everything for you

Your loan is still managed on the LoanBox platform, so you still have access to the same lenders and receives the same alerts.