Which lenders are a good match for a Limited-Service Restaurant SBA loan?

Limited-Service Restaurant project state SBA 7(a) loan approvals in 2020.

Limited-Service Restaurants Industry Highlights

In 2020 the Limited-Service Restaurants industry ranked #2 in SBA 7(a) number of loan approvals and was the #4 ranked industry for loan approval amounts.

All-time there have been 2,217 lenders who have approved 47,155 SBA 7(a) loan approvals to Limited-Service Restaurant businesses for $12,381,912,943. Loan approvals went to borrowers from 6,376 cities for projects in 50 states.

In 2020 Limited-Service Restaurants businesses received 1,233 SBA 7(a) loan approvals from 380 lenders for $578,306,047. The average loan approval amount in 2020 was $469,024. Approvals went to borrowers from 761 cities for projects in 50 states.

For 2020 franchised Limited-Service Restaurants SBA lending there were 238 lenders who approved 704 SBA 7(a) loans for $418,118,547 for an average loan amount of $593,918.

Our forecast model projects the Full-Service Restaurant industry receiving $678 million in SBA 7(a) approvals in 2021.

Read our Industry page on Limited-Service Restaurants SBA lending for a full report, but below are a few highlights:

Historical SBA 7(a) Lending for Limited-Service Restaurants

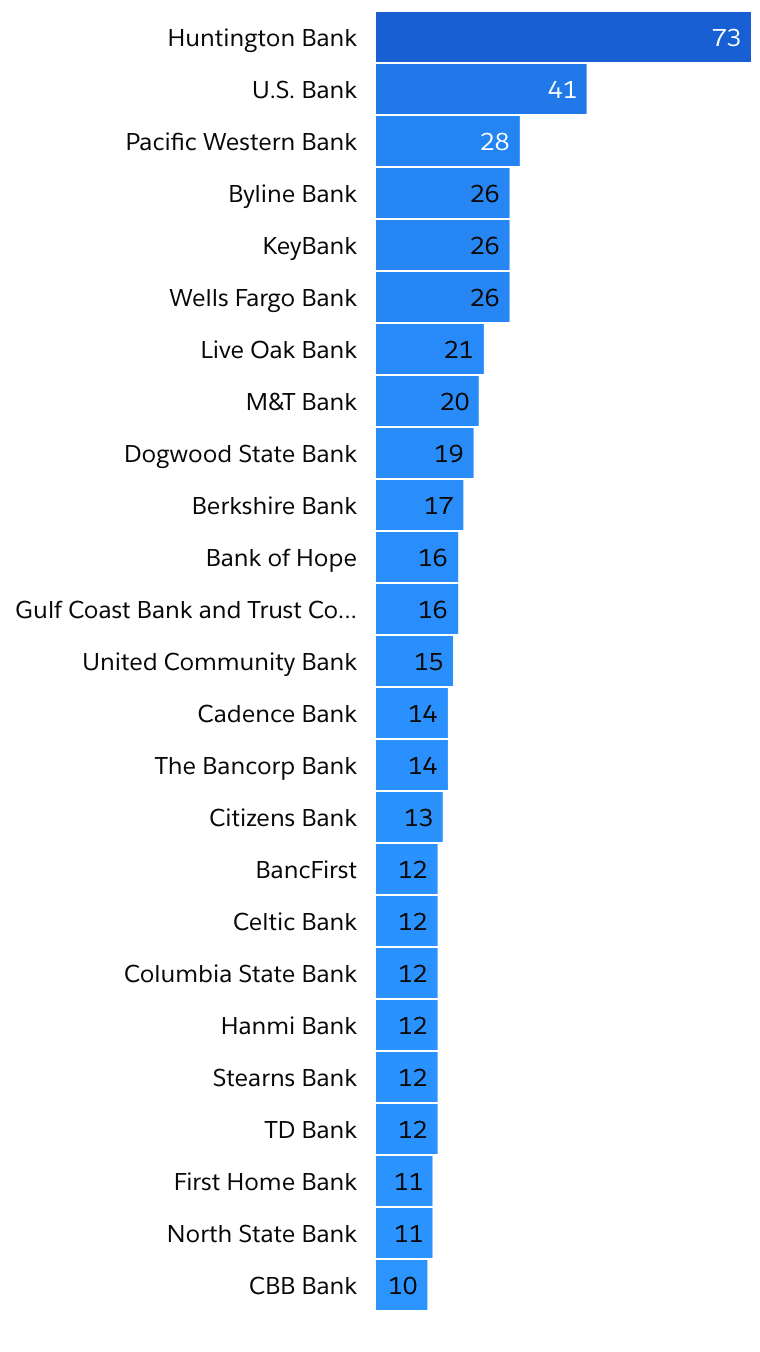

2020 Top 25 SBA Lenders

Limited-Service Restaurants

Loan Approvals

Approval Amounts

Limited-Service Restaurants SBA 7(a) Loan Amounts

Average SBA 7(a) loan approval amount in 2020 was $469,024.

58.48% of approved loans in 2020 were for loan amounts up to $350,000.

27.58% of approved loans in 2020 were for loan amounts up to $150,000.

10.63% of approved loans in 2020 were for loan amounts over $1 million.

3.17% of loan approvals were for multi-million loan amounts.

Limited-Service Restaurants SBA 7(a) Lending Forecast

Our forecast model projects the Limited-Service Restaurant industry receiving $678 million in SBA 7(a) approvals in 2021.

See our full (and free) SBA report on Limited-Service Restaurants

This report has about everything a small business owner would want to know about SBA 7(a) loans to Limited-Service Restaurants. See the 2020 top ranked lenders and franchise brands by loan amounts, default data, our SBA lending forecasts, the top project states and borrower cities, and more.