What to know about Marco’s Pizza franchise SBA loans

Marco’s Pizza franchises project state SBA 7(a) loan approvals in 2020.

Marco’s Pizza Franchise SBA Lending Highlights

2020 Year End

13 lenders approved 26 SBA 7(a) loans for $11,529,700. The average loan approval amount in 2020 was $443,450. SBA loans were approved to borrowers from 26 cities for projects in 11 states.

Historical

85 lenders approved 348 SBA 7(a) loans for $113,842,889. SBA loans were approved for borrowers from 268 cities, for projects in 27 states, with an average loan approval amount of $327,135.

SBA Rankings

For 2020 franchise loans in the Limited-Service Restaurants industry Marco’s Pizza ranks #8 for loan approvals and #11 for approval amounts.

Charge-offs (Defaults)

2.25% of loans were charged-off by SBA lenders for the 10-Year Period Ending 2019.

1.77% of loans were charged-off by SBA lenders for the 10-Year Period Ending 2018.

The difference between a charge-off and a default, and the SBA loan default paradox

Read our free SBA Franchise Report for Marco’s Pizza for a full report, but below are a few highlights:

Historical SBA 7(a) Lending

Marco’s Pizza Franchises

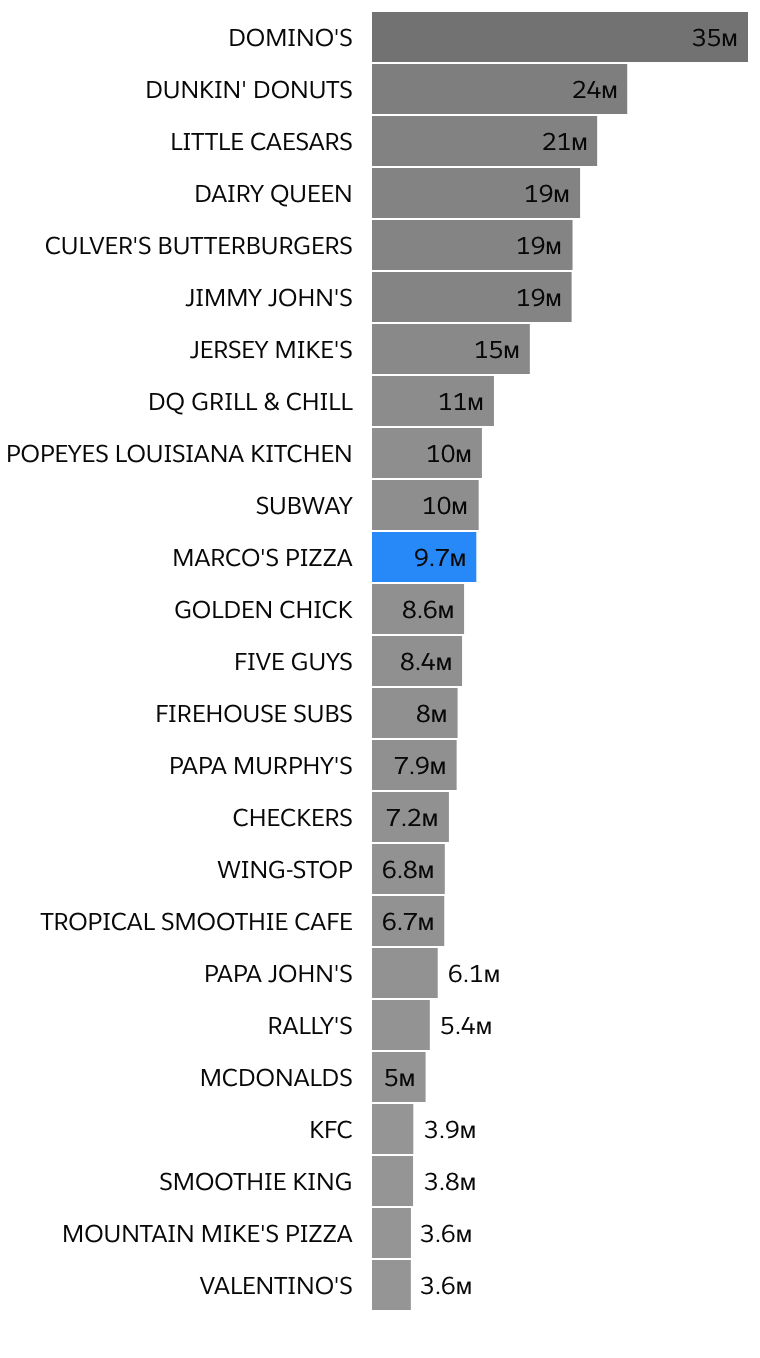

2020 Top 25 Franchise Brands

Limited-Service Restaurants SBA 7(a) Loans

Loan Approvals

Approval Amounts

2020 Top 25 SBA Lenders

Marco’s Pizza Franchise Loans

Loan Approvals

Approved Amounts

SBA 7(a) Lending Forecast

Our forecast model projects Marco’s Pizza 2021 franchise SBA approvals at $11 million and for the Limited-Services Restaurants industry we project $678 million in SBA 7(a) approvals in 2021.

SBA Forecast: Marco’s Pizza

SBA Forecast: Limited-Service Restaurants

See our full (and free) SBA report on Marco’s Pizza

This report has about everything a small business owner would want to know about SBA 7(a) loans to Marco’s Pizza franchise businesses. See the top rankings, lenders, loan amounts, default data, forecasts, the top project states and borrower cities, and more.