Subway franchise business rankings for SBA loans in 2020 FY

Subway Highlights For SBA 2020 Fiscal Year

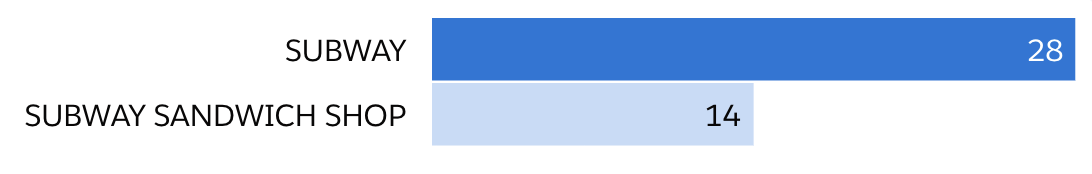

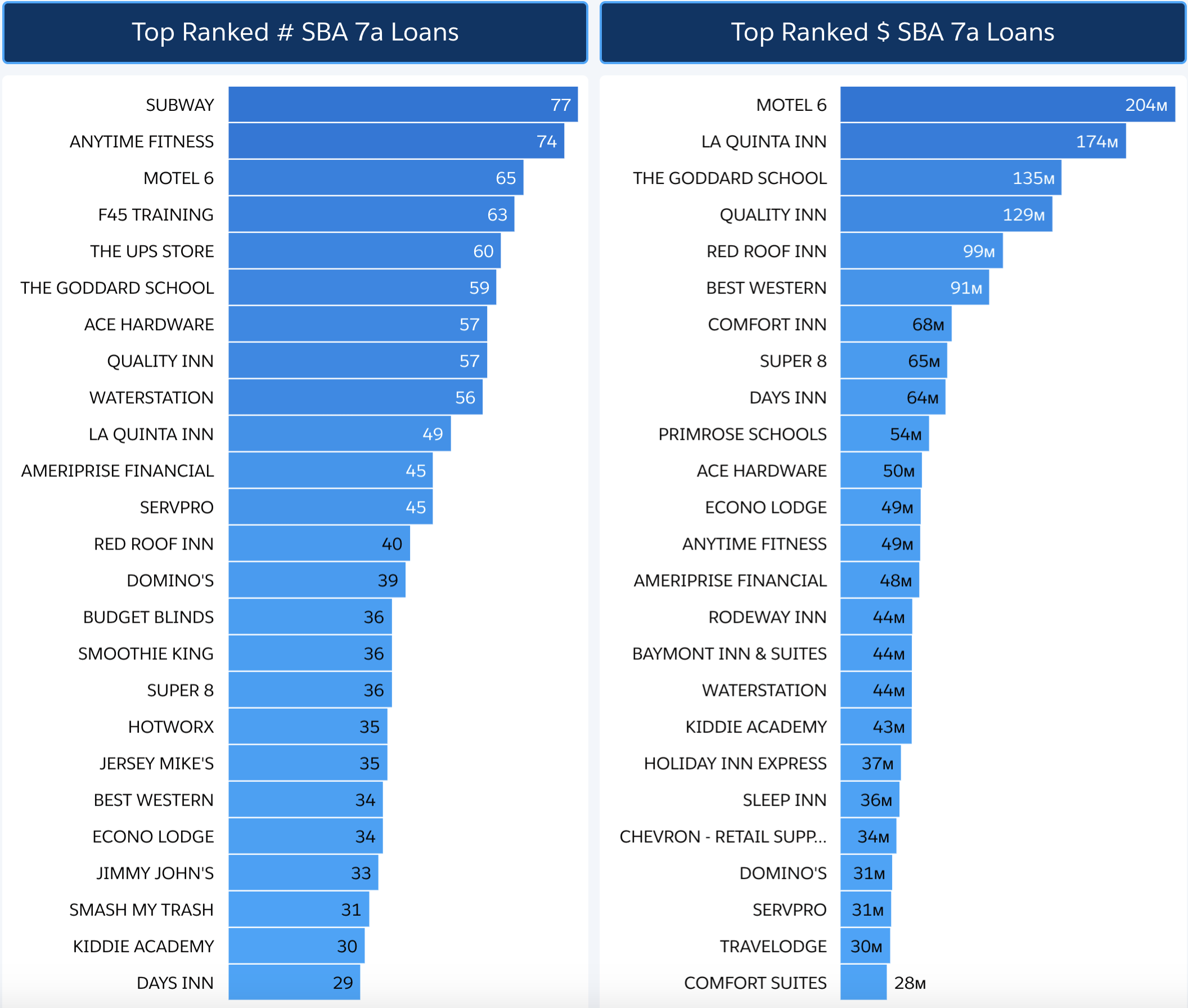

Subway ranked #1 in total number of approvals in the SBA 2020 Fiscal Year out of all franchise brands for all loan amounts.

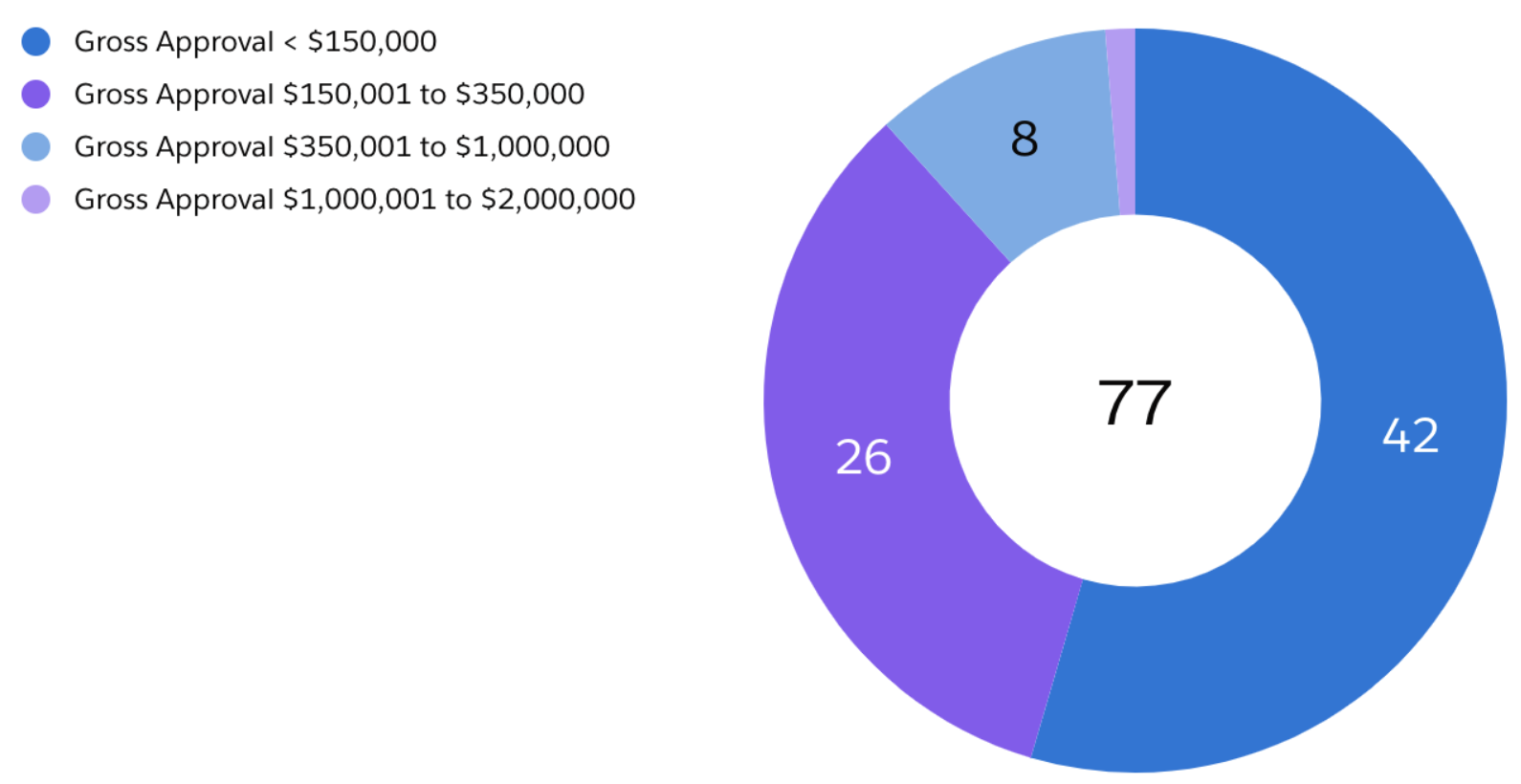

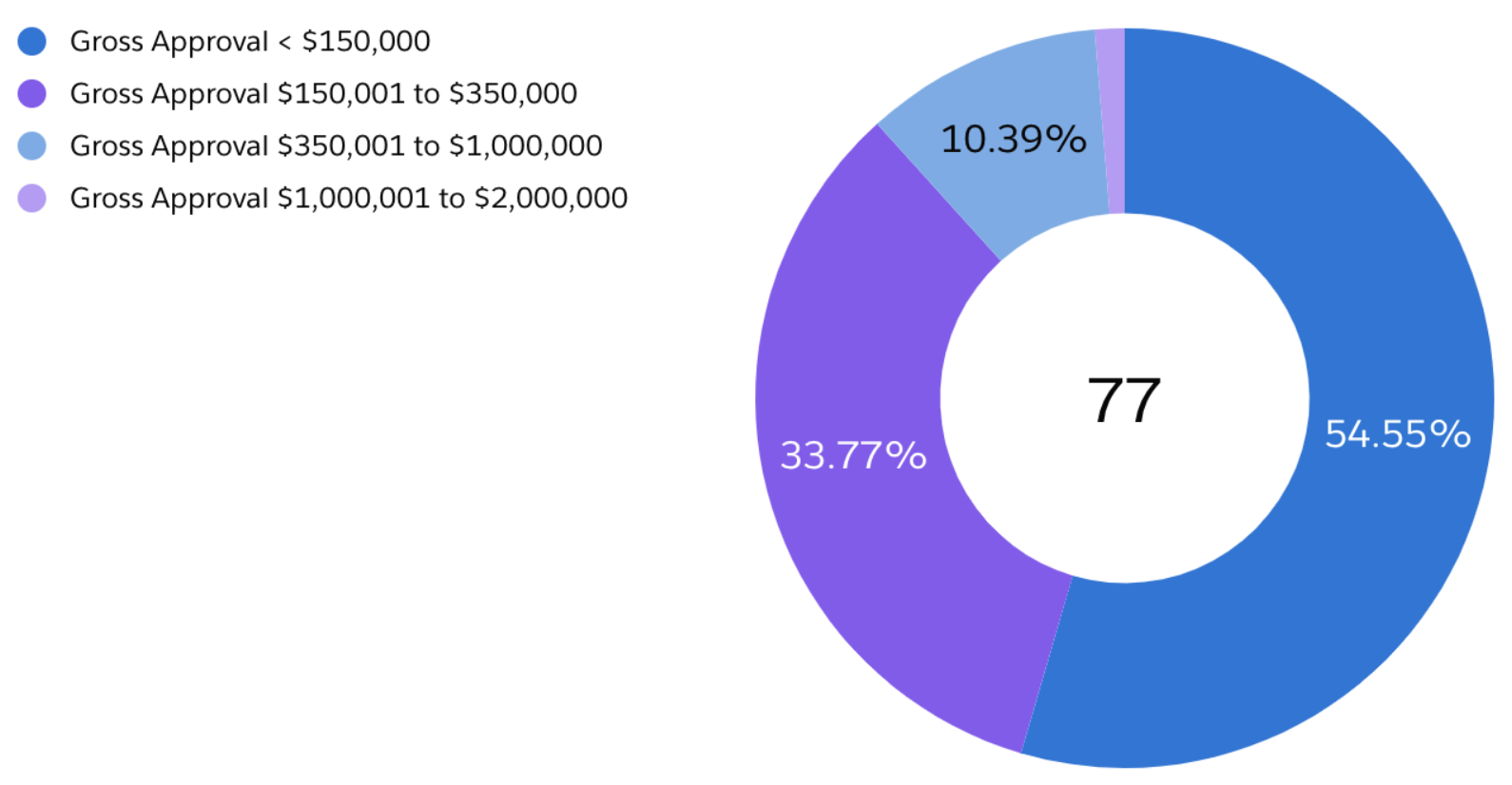

There were 77 approved Subway franchise SBA loans in the 2020FY for $14 million. The average loan approval amount was $185,592.

Most of the project state loans for Subway were in OH (18), IN(9), MI(7), PA(5), and CA (4).

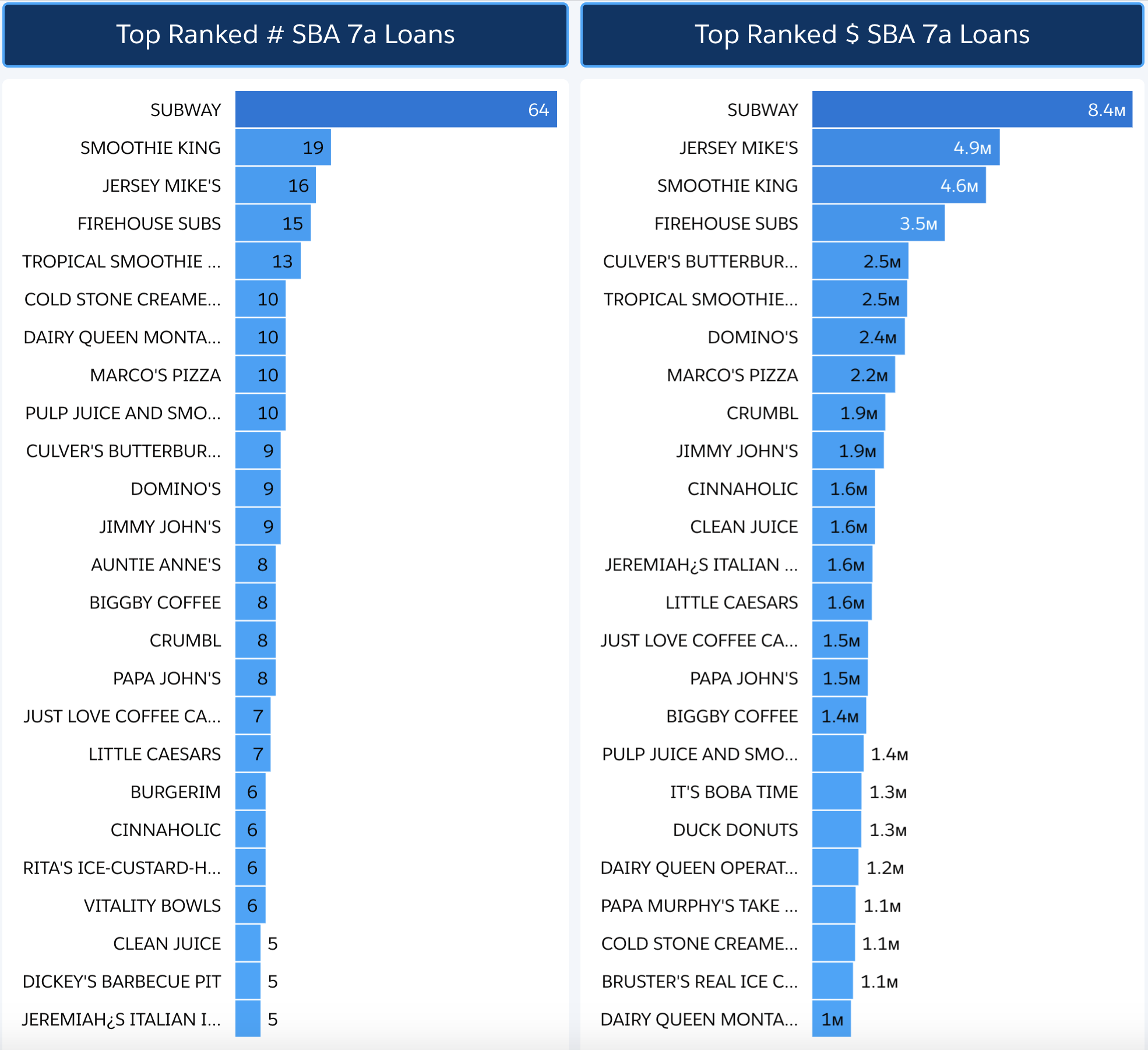

For loan amounts up to $350,000 for the Restaurants and Eating Places industry group, Subway ranked #1 for approved dollar amounts for franchise business loans with 64 for a sum of $8.4 million.

55% of Subway loans were approved for under $150,000 and 34% for amounts between $150,001 and $350,000.

Subway #1 For Number Of Approvals For Franchise Businesses

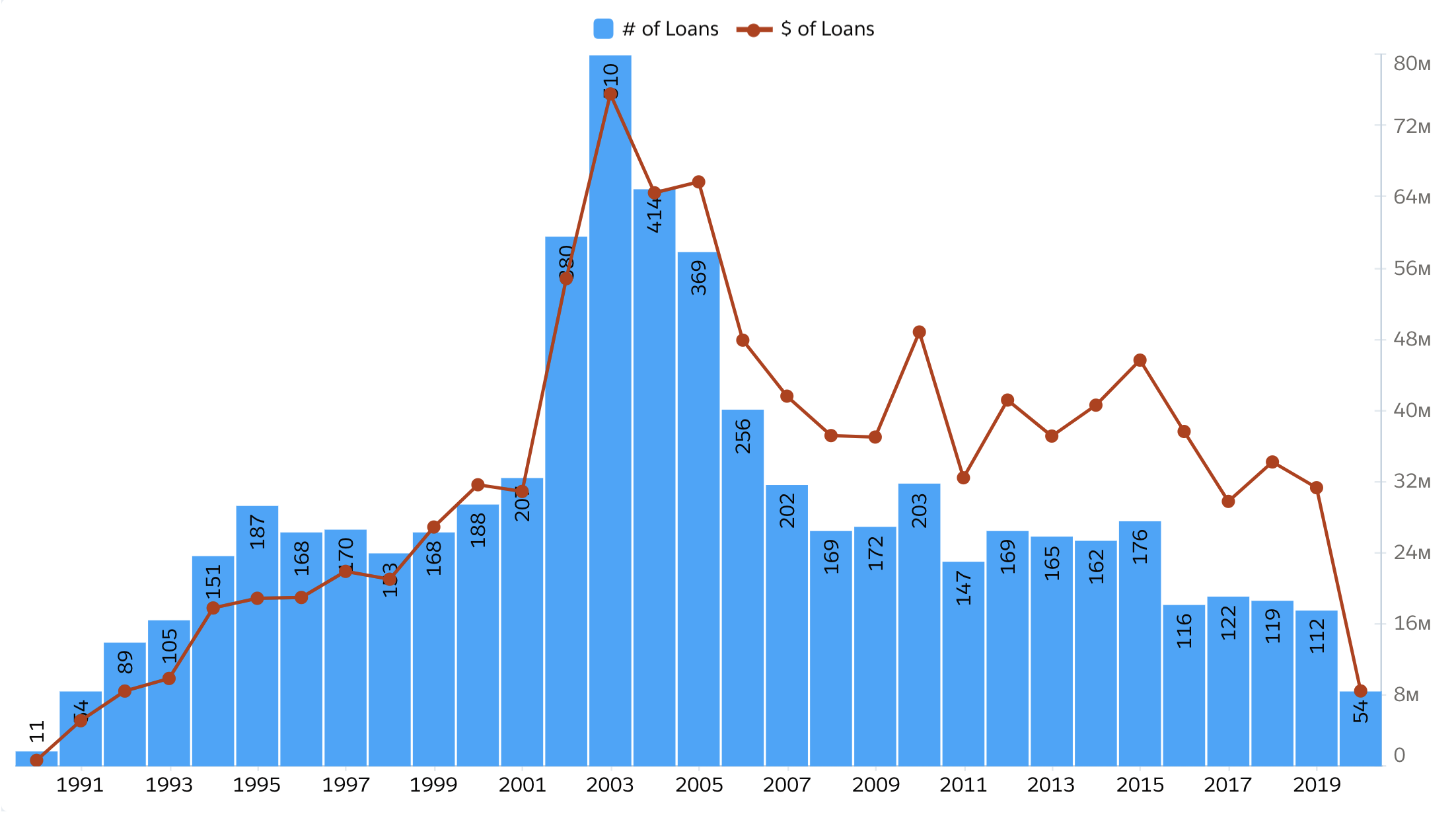

Subway SBA 7a Lending

Through 9/30/2020

2020 FY Average Loan Amount: $185,592

Loan Amount Tiers for 2020 FY

Charge-off data for 10 year period ending 2019

Over the most recent 10 year period, there were 42 Subway franchise loans charged-off representing just over 3% default rate over this period.

How Subway Ranks In SBA Lending

Franchise Branded Business Loans

2020 FY

How Subway Ranks

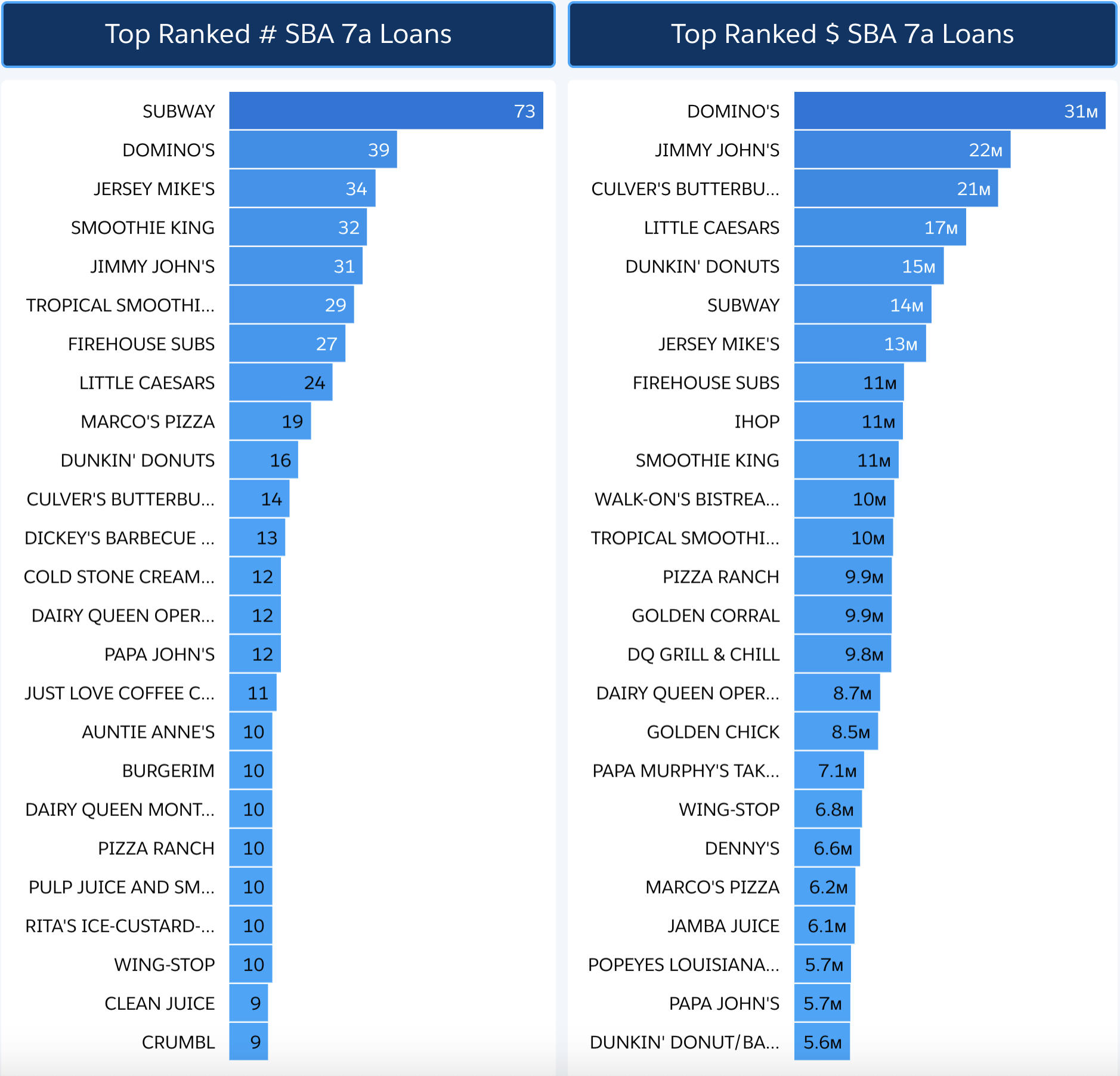

Franchise Branded Business Loans

Up To $350,000 SBA 7a Approvals In 2020 FY

Franchise Branded Business Loans

Industry Group: Restaurants and Eating Places

2020 FY All Loan Amounts

Franchise Branded Business Loans

Industry Group: Restaurants and Eating Places

2020 FY Loan Amounts Up To $350,000

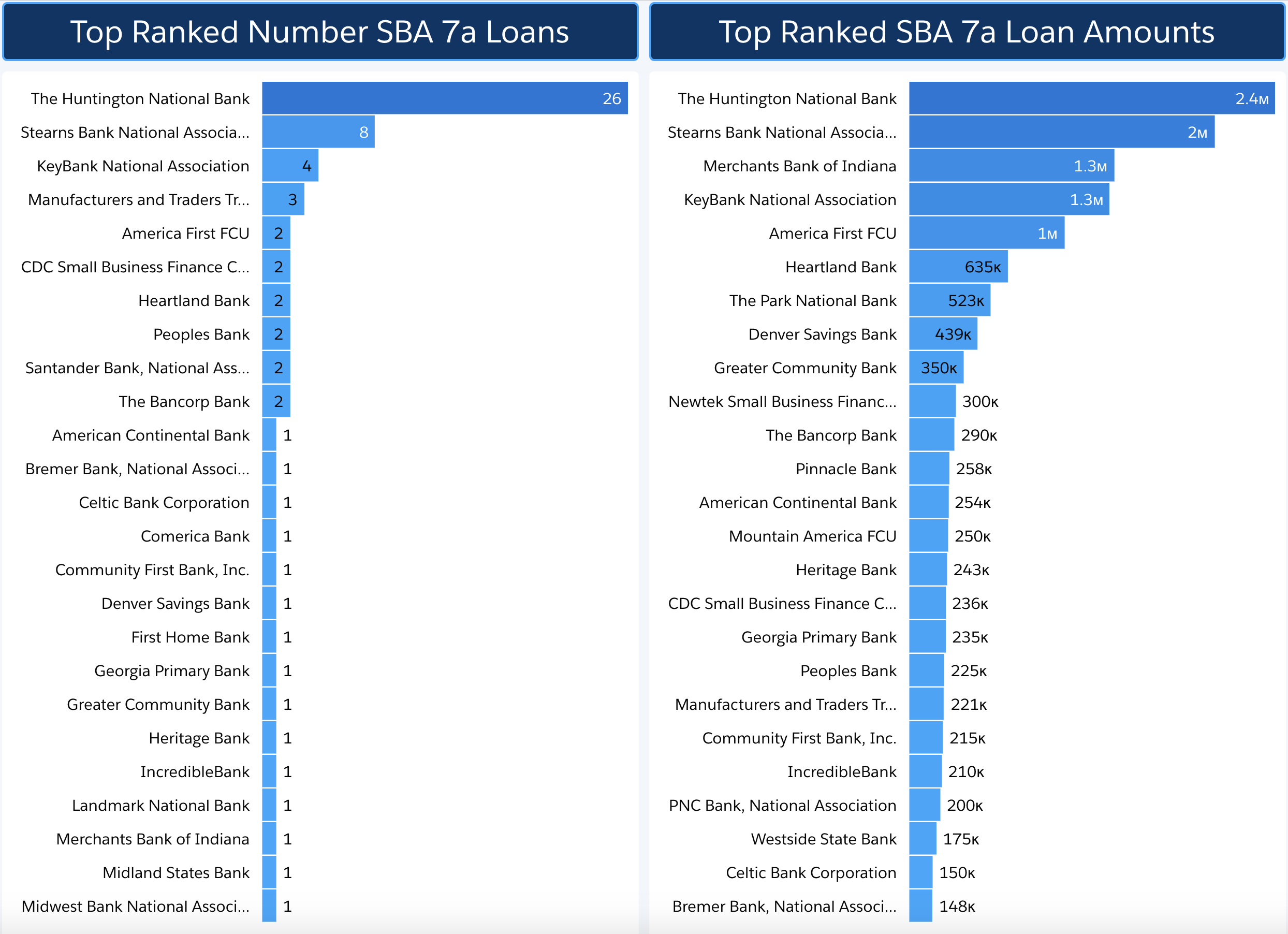

The Top SBA Lenders

For Subway Franchise Business Loans

2020 FY

The Industry Codes Lenders Selected for Subway in 2020 FY

Subway Franchise Loans 2020 FY Project State Map

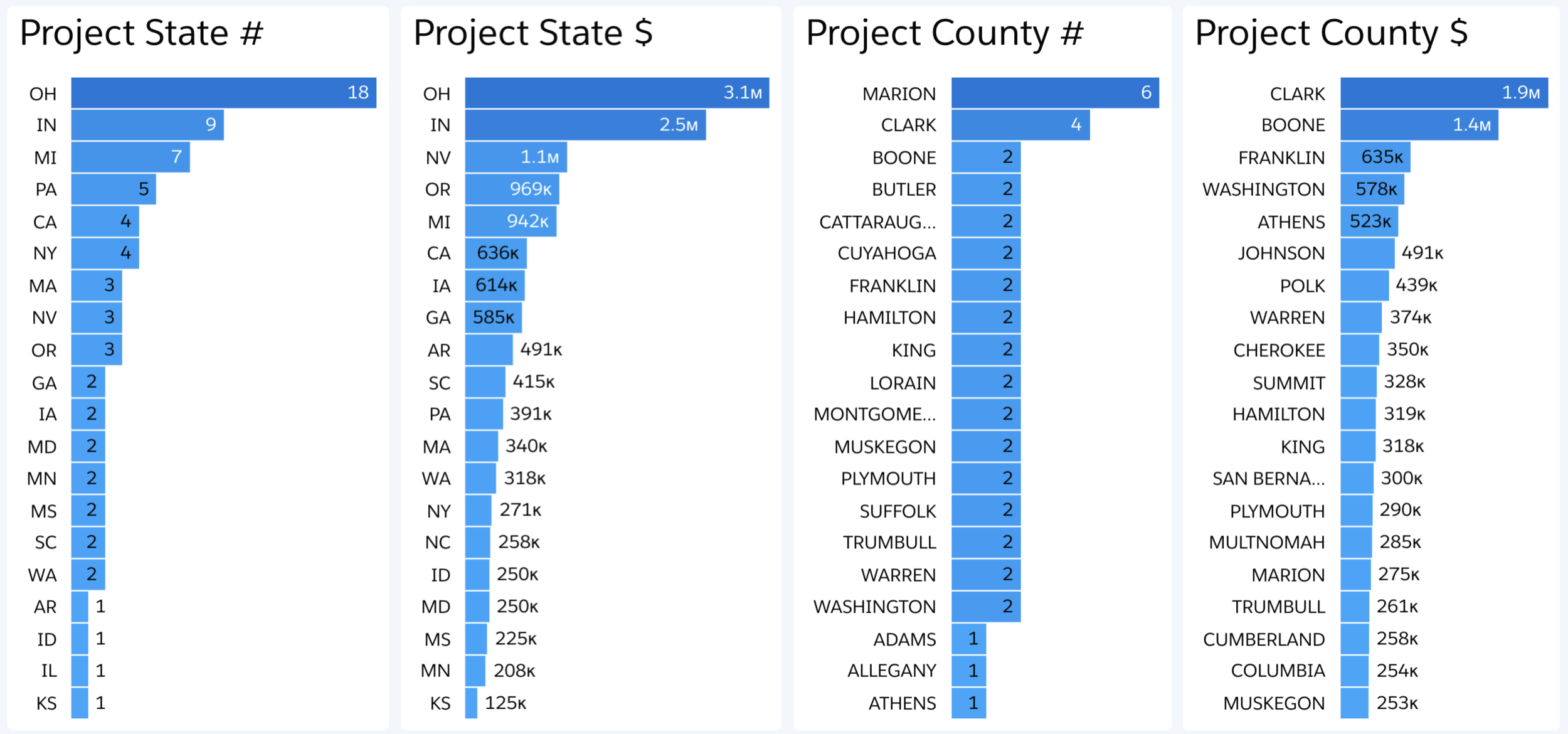

Top 20 Project States and Project Counties for Subway Franchise Business SBA7a Loan Approvals for 2020 Fiscal year (ending 9/30)

Subway Franchise Business

2020 FY Top Borrower Locations

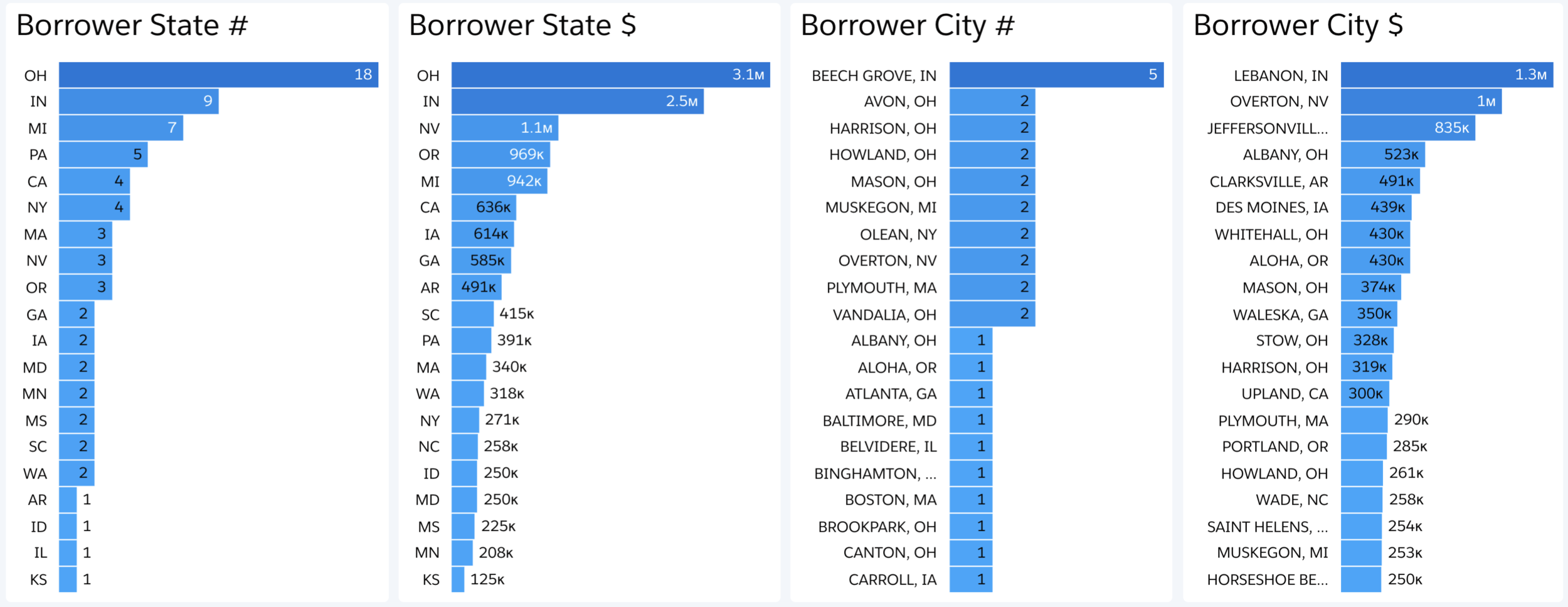

Top 20 Borrower States and Borrower Cities for Subway Franchise Business SBA7a Loan Approvals for 2020 Fiscal year (ending 9/30)